Navigating the Turbulence: An In-depth Analysis of the Predicted Decline in Uniswap’s Price

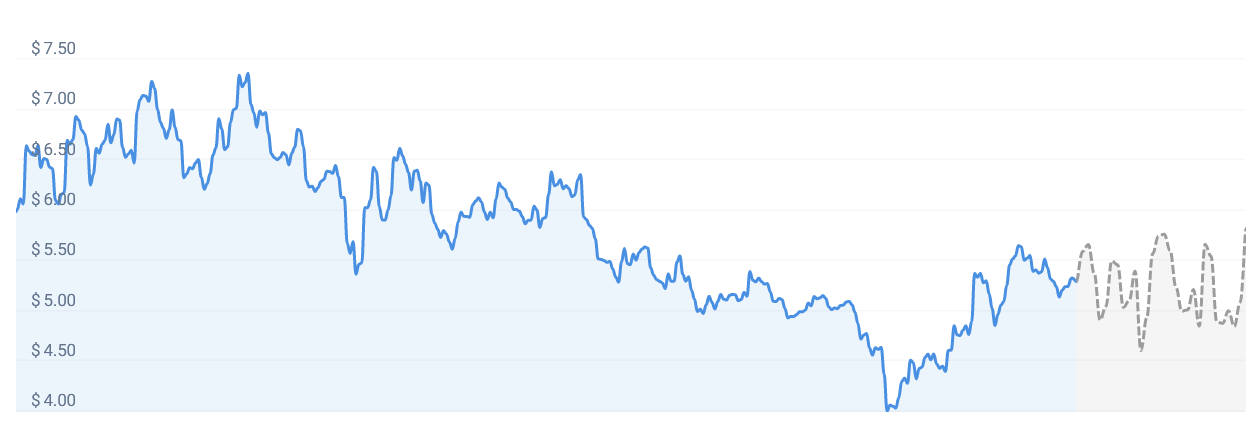

Uniswap, one of the dominant players in the DeFi (Decentralized Finance) landscape, is a topic of fervent discussions among crypto enthusiasts, traders, and analysts alike. However, our latest analysis points towards a potential hiccup in Uniswap’s hitherto promising journey. Based on our current price prediction model, Uniswap’s price is projected to dip by approximately -7.20%, bringing it down to around $ 4.91 by July 17, 2023.

This forecast, shaped by intricate mathematical models and algorithms, is corroborated by our technical indicators. Currently, the sentiment for Uniswap, as per our analysis, stands at “Bearish”. This designation indicates that the market could be trending downwards, as more traders are looking to sell their holdings rather than buy. It’s a crucial signal to potential investors about the current market sentiment, which appears to be swaying towards an expected downturn.

The Fear & Greed Index is another critical tool used to evaluate the emotional state of the market. It oscillates between extreme fear, which could indicate a selling spree, and extreme greed, often synonymous with a buying spree. Interestingly, despite the bearish sentiment, the Fear & Greed Index for Uniswap currently stands at 57, indicating “Greed”. This seeming contradiction may point towards a complex market scenario where fear of missing out (FOMO) is contending with a bearish outlook.

In the past 30 days, Uniswap’s performance has been fluctuating but resilient. It has recorded 16 out of 30 green days, accounting for 53% of the period. Green days are those in which the cryptocurrency closed at a price higher than its opening, reflecting the potential for returns despite the overall bearish sentiment. This stat might suggest that while the broad sentiment leans towards a price decline, there are still periods of growth and recovery, though they might be short-lived or less frequent.

Further adding to this complexity is Uniswap’s price volatility, which was recorded at 8.19% over the last month. In the dynamic world of cryptocurrencies, volatility is not always a dire sign but often represents the breadth of opportunities. While it undeniably indicates a level of risk due to price fluctuation, it also opens avenues for substantial gains if navigated correctly.

Nevertheless, as it stands, our Uniswap forecast concludes that it may not be an opportune time to invest in this cryptocurrency. This cautionary stance is based on a comprehensive understanding of the market conditions, technical indicators, and the predicted price trend. It is imperative for potential investors to comprehend that investing in cryptocurrencies such as Uniswap comes with its share of risk due to their volatility and susceptibility to market news, technological developments, and broader economic trends.

In summary, our predictive analysis points towards a decline in the price of Uniswap in the coming days. Despite the ‘Greed’ on the Fear & Greed Index, a bearish sentiment prevails, suggesting that potential investors might want to tread carefully. As always, it is advised that every potential investor should conduct extensive research, stay updated with the market trends, and possibly seek expert advice before making any financial decisions in the highly volatile and unpredictable world of cryptocurrencies.